IP-centric businesses whose shares trade on the public markets come in many shapes and sizes — some are better suited for return than others.

Many of the most interesting IP-rich businesses, from an investor perspective, are publicly traded, thinly capitalized companies with experienced management. The best have a realistic view of their IP assets, usually patents, and the timing and cost of their disputes and value of potential licenses.

The emergence of public IP-rich companies (PIPCOs) whose shares trade on the global exchanges is presenting new opportunities for patent holders and investors alike. They are the subject of the next (March) Intangible Investor, “PIPCOs – A Business Model Whose Time Has Come,” due out in IAM next week.

Pure-play licensing businesses, non-practicing patent licensing companies with a single method of generating return, are being challenged by business models that provide more options and potentially greater return. Through self-generation, acquisition or merger with complimentary operating units, publicly held licensing companies are emerging as businesses that are more readily understood by investors, able to access the capital markets, and acceptable to the courts.

Global Interest

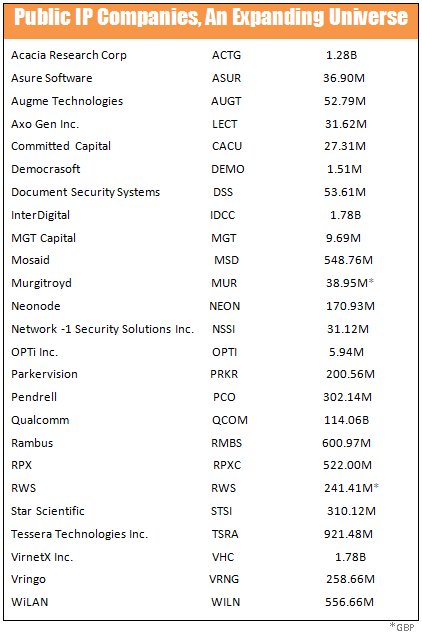

At last count, there are no fewer than 25 companies that trade on US, UK and Canadian stock exchanges that include among their primary goals direct patent monetization. As recently at 18 months ago they would all be considered NPEs.  Today, only a few are licensing-only pure-plays. The mix now includes enforcement businesses that support inventors and SMEs; licensing businesses that conduct proprietary R&D and obtain patents through filings; and those sometimes called profiteers that acquire rights from others, including operating companies that stand to profit.

Today, only a few are licensing-only pure-plays. The mix now includes enforcement businesses that support inventors and SMEs; licensing businesses that conduct proprietary R&D and obtain patents through filings; and those sometimes called profiteers that acquire rights from others, including operating companies that stand to profit.

More public IP businesses today are a combination of models that include smaller, under-capitalized operating companies that are selling products or attempting to commercialize them. While the patent monetization business makes good sense, it is not for every holder or investor.

With the exception of Qualcomm, Acacia, InterDigital and VirnetX, all with billion dollar plus valuations, public IP companies tend to be companies whose value is under about $500m. Mosaid, Tessera, Rambus and WiLAN comprise the next tier, between $500m and $1b. The remaining 17 companies are what Wall Street calls micro-caps.

They include Vringo and Document Securities Systems, DSS, an anti-fraud and brand protection business with patents and trade secrets which has announced a merger with patent monetization firm, Lexington Technology Group. LTG (which BBA advises) is headed by IP veterans Jeff Ronaldi , who has run successful technology and monetization businesses, and Peter Hardigan, formerly director of investment management at IP Navigation Group and a Principal heading IP transactions at Charles River Associates. Warren Hurwitz, co-founder with Rob Kramer of Allied Security Trust, a successful IP private equity fund which has sold a $46 million portfolio to RPX, recently joined LTG as a director. The merger is set to close late 1Q.

Defensive-minded patent-rich companies, like Microsoft, IBM and Samsung, arguably are also PIPCOs, although their lofty market cap and abundant revenue streams make their shares less dependent on the outcome of IP disputes. The lack of broad ownership of smaller PIPCOs means that they are frequently misunderstood and their shares are sensitive to news, good and bad.

For stoic investors looking to take advantage of still inefficient market for generating a return on infringed patents, PIPCOs may be an option whose time has come.

Illustration source: csmonitor.com; Brody Berman Associates

Market data as of 2/1/13.

Bruce Berman gets it! Great IP insight. The rise of the PIPS.

LikeLike

Nice summary Bruce ! Let’s catch up next week if you’re around. Peter

________________________________

LikeLike

A busy week but I am around. What’s yours look like?

LikeLike