IP CloseUp 30 is a handy tool for those who want to track the most active IP stocks in an instant.

IP CloseUp is pleased to announce the IP CloseUp® 30 a free, all-in-one information update of the leading patent stocks. A click or a tap is all investors, innovators, lawyers and or businesses to track the ups and downs of the rapidly expanding universe of IP-sensitive stocks.

In addition to Acacia, WiLAN and Virnetx, smaller players like Marathon Patent Group, Augme Technologies and MGT also are represented. The list will be updated periodically and companies are likely to be added or dropped.

Criteria for inclusion in the IPCU 30 index includes:

– A company must have IP rights, typically patents, as part of its core value proposition.

– The company must be publicly held for at least one month and reporting.

– Companies may hold significant IP rights but do not have to be out-licensing or direct monetization businesses.

– Listed companies have to file required regulatory disclosures and are encouraged to provide discretionary ones. (Transparency counts.)

*MOSAID is listed because it had a purchase value of $594 USD when it was taken private by Sterling Partners in late 2011 and is likely to go public or be sold to a public entity at some time in the future.

Expanded List

Our goal is to expand the list beyond 30 companies and to include more IP-rich companies whose model does not necessarily include monetization or enforcement-driven patent licensing. Not all the companies on the current list are non-practicing (patent owning) entities (NPEs),

or so-called patent assertion entities (PAEs) that have been established to solely to enforce. Examples of these companies include Document Securities Systems and Single Touch, which are small, potentially under-priced operating companies with significant patents.

or so-called patent assertion entities (PAEs) that have been established to solely to enforce. Examples of these companies include Document Securities Systems and Single Touch, which are small, potentially under-priced operating companies with significant patents.

Companies listed in the IP CloseUp® 30 tend to be more directly affected by developments regarding their IP rights. For example, if Samsung settles a dispute with Apple for $1 billion, it is barely a blip on either company’s radar. It’s may not even be worthy of an 8K filing. If an IPCU 30 company secures a license for say $10 million, it is not only material, it is likely to move the corresponding revenue needle and stock price.

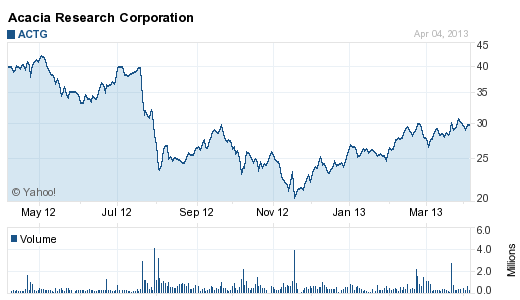

The five menu-tabbed views based on Yahoo! Finance data found in the IP CloseUp® 30:

Basic: This includes pricing and trading information, as well as market capitalization or market value. It also provides access to a chart and recent information, including key statistics. Scroll down for the most recent company news.

Performance: 52-week range

Real-Time: % change

Fundamentals: Includes average daily volume, earning per share (EPS), price earning ration (P/E), if applicable, yield and EBITDA.

Detailed: This offers probably the most convenient summary, including bid and ask, market cap, P/E and EPS, as well as optional monthly, weekly or daily share price and trading volume.

Custom permits you to create your own screen, including or excluding information you may require.

* * *

Copy and paste the IP CloseUp® 30 link into your browser or create an icon for your desk top and watch the these companies evolve. Suggestions about new companies to add will be considered.

Image sources: Yahoo! Finace; Brody Berman Associates

* * *

IP CloseUp 30, by capitalization:

3 comments