IP backed securitizations or loans, commonly known at IP finance, rely on the ability of issuers like financial institutions to accurately value intangible assets, such as patents, copyrights and trademarks.

Developments in data analysis, such as generative AI, are making valuations more reliable and a marketplace IP transactions more feasible.

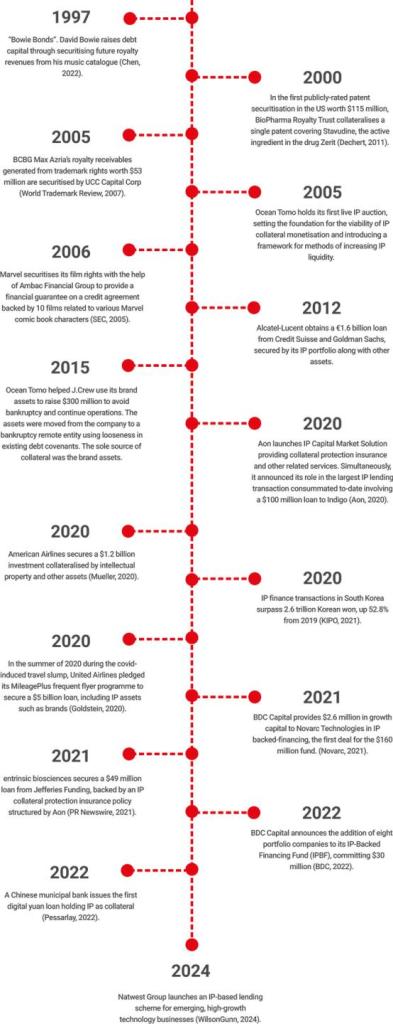

Deals have gotten somewhat more interesting for issuers since the David Bowie royalty receivables deal in 1997, which generated an attractive return for Bowie but less so for investors. The market really didn’t know what to make of this royalty stream amidst an emerging Internet, and often traded “Bowie Bonds” at a discount.

Many investors do not realize that IP monetization, including IP finance, is not synonymous with patent “trolls.” IP finance is a subset of IP monetization that is about generating a return on IP rights, typically by using them as collateral. Without an associated revenue stream, however, loan predictability can be incredibly difficult. Risk avoidance can be worth more to some businesses than a big fat damages award or lucrative in-license. But you won’t find that on the balance sheet, or many lenders providing capital on them.

IP monetization depends on the industry, technology and company where the rights are owned.

What’s Understood vs. What’s Not

IP-related revenue streams – e.g. patent licensing, music royalties, income associated with successful branded products – are attractive for many reasons. They are readily understood by executives as high-margin income. They can be modeled with a degree of accuracy and discounted, if necessary. They can be housed offshore in an effort to avoid taxes and time their use with other balance sheet considerations. But types of value and ROI vary by industry, technology and company size. What works for a winning pharma drug may not for the latest GPU chip.

For strategic or defensive IP assets, e.g patents where the value is in preserving market share for a particular product or discouraging competition, it is much greater challenge to quantify return.

This has been a stumbling block for IP monetization, and especially its subset, IP finance. Return on IP (what I call ROIP) is different from return on real estate, which has relative predictability because of rents, leases and market comparables and a relatively degree of liquidity. IP assets are often regarded on a case by case basis because each is “in a class by itself” and there is little or no marketplace for these assets. Effectively, there are no comparisons. Patents are more challenging in this regards than copyrights and trademarks, where cash flows can be more distinct

Getting the most out of IP rights and qualifying the return should be a fiduciary responsibility of every board, especially when intangible assets, which IP rights are a large part of, comprise as much as 90% of most large companies value. Despite the amount of intangible assets that boards oversee, they often do not view them as part of management’s performance oversight.

What’s different today according to an article by J.S. Held that appears in IAM is that there is now a 27-year history of it. In an article about the history of IP finance, “Recipes for success in IP-backed finance,” they “trace the history of IP finance, notable transactions, benefits of IP finance and collateral, and IP finance risks.”

Not to be confused with IP monetization, “intellectual property finance can broadly be defined as loan agreements that feature IP assets as collateral,” suggests J.S. Held. Certainly, an important part of generating a return on IP, the IP collateral in loan agreements is typically an afterthought, not central to a transaction.

The Future of IP Monetization

How difficult to discern ROIP is measured is what I believe to be key to the future of IP finance, in particular, and IP monetization, in general. If it can be conducted more reliably there are few limits to the the type and number of transactions that are possible. Those leading the way include some private equity firms, such as Royalty Pharma, a specialist in financing and acquiring cash flow receivables, and litigation funders, like GLS Capital.

A highly successful form of IP finance/monetization is associated with the sale of celebrity music catalogues, like those of Bob Dylan ($500M), Bruce Springsteen ($500M) and Sting ($300M).

Many investors do not realize that IP monetization is not synonymous with patent “trolls,” nor is IP finance.

A music catalogue is basically a collection of songs by a single artist whose rights are held by an individual (the artist) or entity (a group or record label). All such previously produced work is also called back catalogue. When a catalogue is ‘bought,’ it implies that the rights of the songs exchange hands.

“Although copyright laws differ by country, at least in the US, Europe and much of the Western world,” reports PresitgeOnline.com,

“all songs have two copyrights: recorded rights, which include rights to master recordings, and publishing rights, which comprise lyrics and the melody.

“While recorded rights are connected to sales royalties and streaming, publishing rights are connected to the use of the music in films, television and performances. Though most of the sales of music catalogues involve publishing rights, the recorded rights are more coveted as they grant a steady flow of revenue to the holder with every streaming, download or sale of the songs or the albums.”

Litigation funders have applied the rigor of risk analysis to patent litigation. Many are highly selective and look at patents on multiple levels in various industries, technologies and contexts, selecting fewer than 5% of the opportunities before them. Post America Invents Act (AIA) and several important court decisions, the patent litigation potential of areas like software, internet and ecommerce are quite low. Still, according to Bloomberg News, litigation funders are currently associated with more than 100 IP-related cases, mostly patent litigation.

Making ROIP a Reality

Royalty stream financing is only part of the ROIP mix. Below are some less obvious ways IP rights – including trademarks, copyright and patents – can generate attractive returns. Performance is more readily measured for some than others and does require technical expertise many financial institutions lack.

- Outright IP sale or sale leaseback

- Use strategic patents to maintain market share and profit margins

- Slow competitors

- Increase value of M&A transactions

- Support share price (public awareness)

- Enhance customer/supplier relationships

- Raise capital

- Out-license (revenue generation)

- In-license (risk avoidance)

As capital sources like financial institutions become more comfortable with IP valuation and potential event-risk, they are likely to engage in more transactions. Until then the due diligence and time to profit can be cost prohibitive. IP collateral as part of a loan or bond financing, to my knowledge, is still taken less seriously by lenders. They often see strategic IP rights as a secondary or tertiary form of collateral, no matter the real value.

IP finance and monetization have come a long way; they still have further to go to be fully accepted as an asset class by those skeptical of intangible assets. More deals will lead to greater predictability and comfort. Generative AI analysis and greater awareness of risks associated with IP rights, especially patents, is already helping to address these concerns.

In this still nascent industry, the more deals completed, loans/bonds successfully repaid and collateral repatriated the better.

For those who want to hear more about IP monetization, read my Intangible Investor column in IPWatchdog.

Image source: J.S. Held