China’s share of granted artificial intelligence patents is 62%, approaching two-thirds worldwide. The U.S. comes in at 21% and the EU and UK just 2%

China’s share of granted artificial intelligence patents is 62%, approaching two-thirds worldwide. The U.S. comes in at 21% and the EU and UK just 2%

Alan Nelson, a pioneering biomedical engineer and entrepreneur, shared his three-decades of experience with AI machine learning at the recent IP Awareness Summit. The science,

The Beijing Internet Court (BIC) ruled late last year that an AI-generated image in an intellectual property dispute was a new artwork protected by Chinese

Independent Presidential candidate Robert F. Kennedy, Jr’s Vice President running mate, Nicole Shanahan, is a patent analyst, intellectual property lawyer and entrepreneur who is also

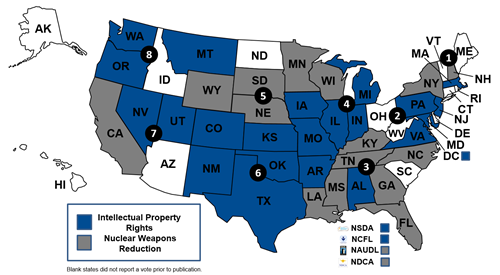

Thanks in part to data-hungry artificial intelligence and growing anger over foreign and domestic intellectual property abuses, fixing the IP system is more topical than

Knowing which IP rights are being used, when and by whom helps to establish their value and return. That is the experience of two leading

The 2024 Intellectual Property Summit will be available to livestream for free in the U.S., Europe and elsewhere, it was announced by the Center for

The relationship of inventions, names, content and designs to intellectual property rights, less than clear to most people, has been complicated by the emergence of

Microsoft has overtaken Apple in the two-decade long global competition for the company with highest market capitalization. Microsoft’s market value stood at $3.021 trillion at

The frontlines of AI today are comprised not only of computer programmers and generative AI platforms but of thousands of businesses, investors and users who

Six leaders in artificial intelligence and intellectual property rights, including a former Philips and IBM executive, a serial entrepreneur, ex-ITC Commission and current USPTO Director

Between 2005 and 2020 the number of U.S. design patent grants almost tripled. The increased focus on product form (“look”) as a part of function,