China’s share of granted artificial intelligence patents is 62%, approaching two-thirds worldwide. The U.S. comes in at 21% and the EU and UK just 2%

China’s share of granted artificial intelligence patents is 62%, approaching two-thirds worldwide. The U.S. comes in at 21% and the EU and UK just 2%

The Beijing Internet Court (BIC) ruled late last year that an AI-generated image in an intellectual property dispute was a new artwork protected by Chinese

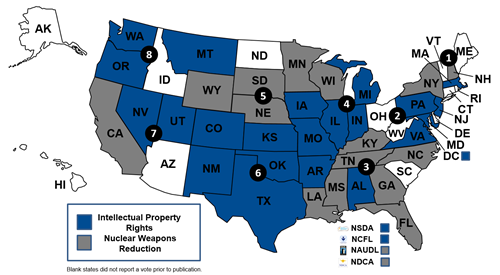

Thanks in part to data-hungry artificial intelligence and growing anger over foreign and domestic intellectual property abuses, fixing the IP system is more topical than

The 2024 Intellectual Property Summit will be available to livestream for free in the U.S., Europe and elsewhere, it was announced by the Center for

Microsoft has overtaken Apple in the two-decade long global competition for the company with highest market capitalization. Microsoft’s market value stood at $3.021 trillion at

The frontlines of AI today are comprised not only of computer programmers and generative AI platforms but of thousands of businesses, investors and users who

Since China became worldwide leader in patent applications in 2011, overtaking Japan, the number of its applications have soared. The question today is not so

Author of “AI for People and Business: A Framework for Better Human Experiences and Business Success” and INDYCAR racing engineer and data scientist Alex Castrounis

A public–private partnership launched by the World Intellectual Property Organization (WIPO) and the Music Rights Awareness Foundation wants to provide musicians and other creators a

IP CloseUp, weekly perspective on intellectual property trends and business, broke through 392,000 views and 272,000 visits in 2023, on its way to 400,000 plus

In a rare joint statement, intelligence leaders from the Five Eyes countries accused China of intellectual property theft and using artificial intelligence for hacking and

Creative expression, like music, films and books, and inventions, that are supported copyrights and patents, impact thousands of businesses, millions of jobs and and our