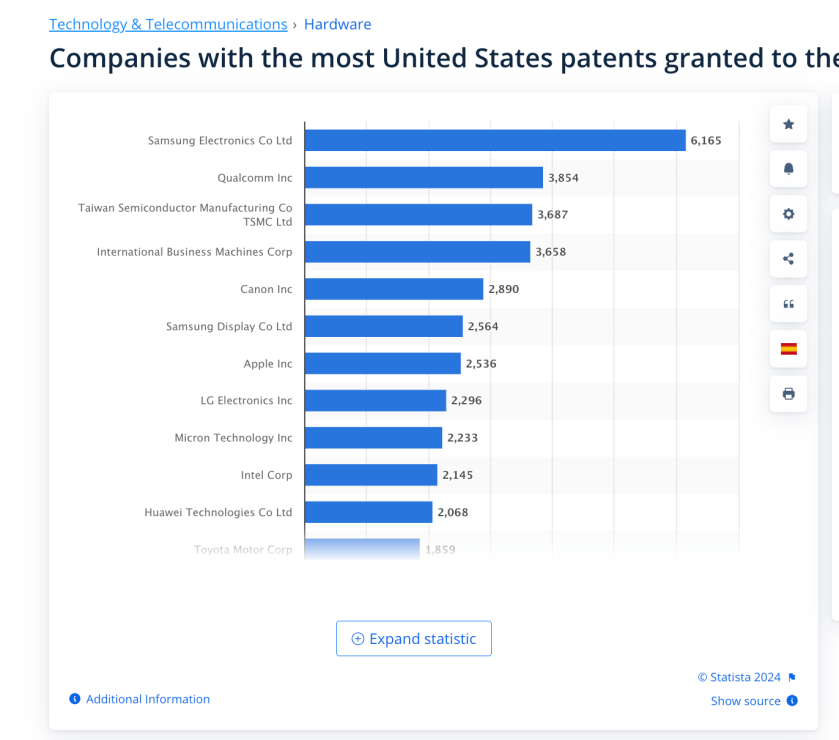

Samsung Electronics Co. Ltd. and Samsung Display Co. Ltd., ranked number one and number six in U.S. patent grants for 2023, together, more than double the closest competitor, domestic or foreign.

It is by far the largest holder of U.S. patents.

While patent grants do not mean everything, for electronics and hardware producers, including chipmakers, they mean a great deal. Excluding the two Samsung entities above, with 6,165 and 2,564 patents respectively, there is little competition. In 2023, Samsung Electronics appears to have held approximately 93,300 U.S. patents, making it the top patent holder here.

TT Consultants breaks down that figure into 48,798 active, 22,076 expired, and 19,412 pending patents. Worldwide, the company has more than 272,000 active patents, according to GreyB data.

Samsung’s reason for splitting patents between entities may be not to look too dominant, or it could be for tax or licensing purposes. When German automaker Daimler (Mercedes Benz) acquired Chrysler U.S. in 1998, it maintained multiple patent entities, including Daimler Chrysler, Daimler U.S., Daimler AG, et al.

U.S. chipmaker Qualcomm comes in second in U.S. patent grants at 3,854, followed by TSMC Ltd. (Taiwan), IBM and Canon. IBM is no longer the annual recipient of the most U.S. patent grants, which it had been for 29 years.

To the surprise of many, Big Blue was never close to being the leader in active U.S. patents held. They received many, but frequently allowed them to lapse if they did not see that maintaining them made business sense. You could say they “open-sourced” them before there was a concerted effort to maintain open source. Samsung has maintained the highest number of active U.S. patents for at least a decade.

While some large technology companies, especially those involved in hardware, electronics and semiconductors, are more active than ever pursuing U.S. patents, others like IBM are deemphasizing them

According to Statista data, of the top 20 U.S. patent grant recipients, half, 10, are foreign-based companies, consistent with the past 30 years. South Korea has five on the list; China two and Japan two. (The Statista link is expandable to include all top 20 grantees.)

Changing Emphasis

What the lists suggests is that while some large technology companies, especially those involved in hardware, electronics and semiconductors, are more active than ever pursuing U.S. patents, others like IBM are deemphasizing them.

Big patent portfolios with significant families still seem to make sense for many of the largest tech companies. The advantages and value of smaller portfolios or one-off patents appear to be declining, except, perhaps, in bio-pharma and chem.

It is interesting to note that Dell, once considered a rather low-tech re-packager of personal computers, received 1,198 U.S. patents in 2023, an indication that its business model may be morphing. AI server sales have appeared as a part of their mix.

Image source: Statista.com