Businesses that spend the highest amounts annually on research and development, anywhere from $10 billion to over $100 billion, are often among the least clear about the results of their expansive outlays.

There is a noticeable divide between big tech offering LLMs and big pharma, with the more highly capitalized technology giants currently spending significantly more on R&D with relatively little to show for it.

Lower R&D expenditures at pharma, semiconductor, automotive and other companies appear to be more directly tied specific products, revenue streams and patents.

To be fair, tech/AI, semiconductor, automotive and pharmaceuticals are very different industries, with unique product and service offerings, different timelines to market and levels of patentability.

But what does R&D really mean? The “development” part, explains Google’s Gemini, “focuses on translating knowledge and ideas from research into tangible, new, or improved products, services or processes.”

It involves systematic work “using scientific and practical knowledge to create prototypes, conduct testing, and ultimately launch new innovations that meet specific commercial objectives or customer needs, contributing to a company’s long-term success.”

Small “R” — Big “D”

Patents obtained are an unreliable indicator of research success. A lot depends on the industry and particular business. Development can mean almost anything from commercializing prototypes, drug trials, sales and marketing expenses to staffing. In many cases, company research is a fraction of development costs. Hence, “small R and big D.”

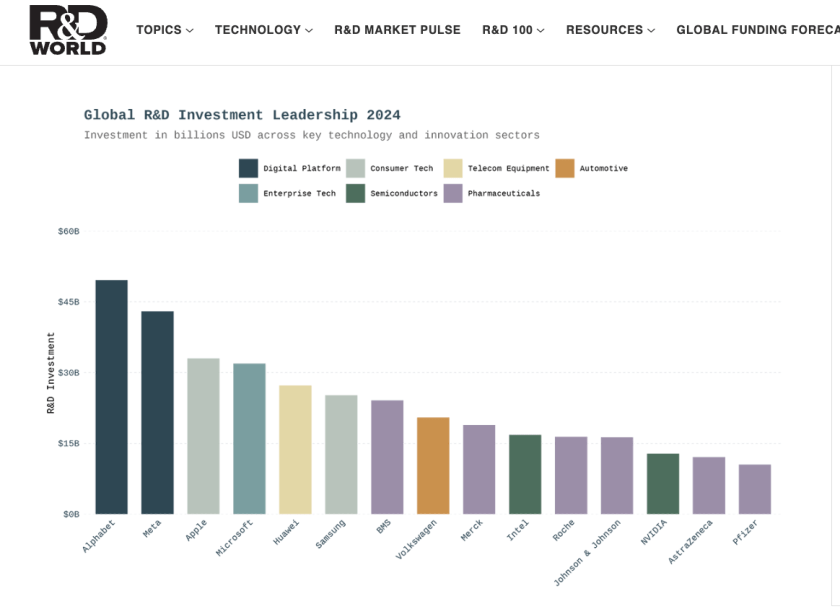

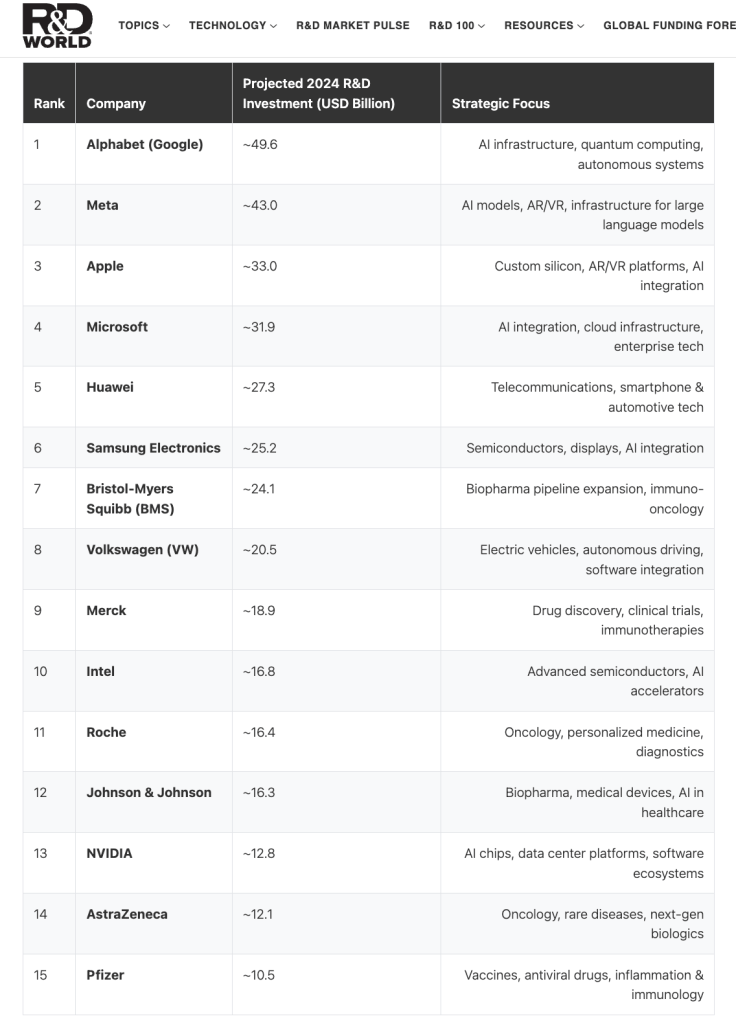

“While stalwarts like Alphabet, Microsoft, and Apple maintain consistent long-term investment patterns,” reports R&D World, “the accelerated trajectory of firms like NVIDIA highlights how strategic bets in emerging AI-driven computing ecosystems along with a deeply entrenched hardware-software ecosystem can rapidly reshape competitive standings.”

It’s telling that AI has emerged as a central focus for the top six R&D spenders—Alphabet, Microsoft, Apple, Huawei, Samsung Electronics, and Meta, reports the publication, which has, for now at least, pivoted away from its earlier metaverse emphasis.

The exact breakdown of R&D specifically for AI is not always publicly disclosed, as these companies often bundle AI-related costs within broader “capital expenditures” (CapEx) for data centers or “Technology and Content” spending.

Alphabet is pushing AI infrastructure, GenAI, and advanced computing at scale, while Microsoft is embedding AI into its enterprise and cloud ecosystems. Meanwhile, Apple is channeling R&D into AI-enabled custom silicon and on-device intelligence while implementing its Apple Intelligence suite across iOS and macOS.

Financial Challenges

Some of the bigger pharma companies have faced recent financial challenges despite high initial prices on blockbuster drugs. In 2024, Pfizer implemented a $4 billion cost reduction strategy, Bristol-Myers Squibb’s $1.5 billion cost-cutting initiative, including significant workforce reductions, occurred alongside strategic acquisitions to strengthen its neuroscience portfolio.

Merck’s situation further aligns with these pressures, as the world’s biggest pharma (by revenue) worked to address the approaching patent expiration of Keytruda, which represents 40% of its revenue.

In 2025, major tech companies are investing heavily in AI, with projected annual spending of tens of billions of dollars each on capital expenditures for AI data centers and research and development. However, the exact breakdown of R&D specifically for AI is not always publicly disclosed, as these companies often bundle AI-related costs within broader “capital expenditures” (CapEx) for data centers or “Technology and Content” spending.

While significant R&D spending can yield breakthrough products and services it can also be a bit of black hole where gravity is so great that neither matter nor light can escape.

Google’s projected capital expenditure for 2025 is $85 billion. A substanding part of that is likely R&D for AI. Microsoft is at $80 billion. Meta, Amazon and others are comparable. Amazon’s capex spend is projected over $100 billion as it plays relative catch up in AI. Relatively few patents, or unusually fundamental ones, are likely to result from these huge expenditures. But that does not necessarily mean the dollars are poorly spent.

It is important to note the impact of a given year’s R&D expenditures at the largest companies is not typically realized until two or more years down the road, when new developments are more likely to be embodied in products and services generating revenue. Attempting to align same year R&D spending with patent grants, which can take years to issue and be applied, and revenue can be misleading.

While significant R&D spending can yield breakthrough products and services it can also be a bit of black hole where gravity is so great that neither matter nor light can escape.

Image source: R&D World