Worldwide semiconductor revenue for 2024 reached approximately $655.9, a 21% increase from 2023, driven primarily by booming demand for AI infrastructure and the growth of one company, Nvidia.

Nvidia is leading the way with its high-end, AI-purposed GPU chips no one else is yet capable of providing on the level demanded by tech giants like OpenAI, Meta AI and Anthropic. Right now, no other semiconductor company appears to be able to supply this lucrative market. IP strategy, especially for patents, appears to be playing a role in Nvidia’s dominance.

Pronounced Leadership

Nvidia’s leadership is most pronounced in the high-growth AI chip market. Estimates from 2024 and early 2025 place its share between 70% and 95%. Some research indicates that Nvidia’s share of AI accelerators, which are essential for training and running AI models, at 85% to 90%.

Lumenci reports that Nvidia has 18,658 patent assets across 26 jurisdictions as of September 2025, respectable by any standard.

The market capitalization of Nvidia, the most valuable public company, $4.3 trillion, tops even Microsoft, Apple and Amazon. The company recently announced that it is investing $100 billion in OpenAI, a major buyer of its AI units and the current LLM leader.

Will Nvidia maintain its dominant market share and high profit margins or is it just a matter of time until a U.S. or Asian company comes along with an alternative GPU? For now, there are no legitimate competitors in sight. Hence, the mind-boggling market cap.

Lumenci reports that Nvidia has 18,658 patent assets across 26 jurisdictions as of September 2025, respectable by any standard. Presumably many of those assets and early grants are fundamental to AI technology, and are not easily designed around. “Fabless” (fabrication-less) Nvidia outsources its complex designs and devotes itself to high margin design, not capital intensive manufacturing.

It is important to remember that research-heavy and capital-intensive semiconductor design is among the few remaining areas where patents appear to make a clear difference and licensing readily occurs.

Nvidia comes up with new GPUs and other chips, then outsources the physical fabrication process to dedicated foundries, primarily Taiwan Semiconductor Manufacturing Company (TSMC).

Ongoing Challenges

NVIDIA faces ongoing challenges and potential disputes regarding its IP, reports ChatGPT (an investor), “particularly concerning the use of copyrighted training data for its AI models and patent infringement claims from other companies.”

The company has been involved in litigation concerning the use of copyrighted materials in its training datasets for AI models, such as NeMo Megatron, with accusations of copyright infringement against authors.

Intel, still the semiconductor industry revenue leader in 2023 despite its declining market share, stock price and valuation, recovered somewhat in 2024 and 2025, with significant investment. The company received a capital infusion from Nvidia ($5 billion), SoftBank ($2 billion) and the U.S. government ($9 billion). There have been discussions with Apple to add to that.

It’s odd that Nvidia would be helping to prop up a potential competitor, but stranger things have happened.

Can anyone catch Nvidia and what role will IP rights play in facilitating or impeding that?

Can anyone catch Nvidia and what role will IP rights play in facilitating or impeding that? There are no clear answers. For now, Nvidia appears to be so strong a player even a semblance of a rival may be beneficial.

A threat to its success could come in the form of next generation patented inventions which the company, somehow, failed to secure or a design so highly innovative, they could not be seen coming.

For now Nvidia is enjoying an industry dominance like no other, supported by thousands of patents, copyrights and, no doubt, many trade secrets and much know how no one except it can access.

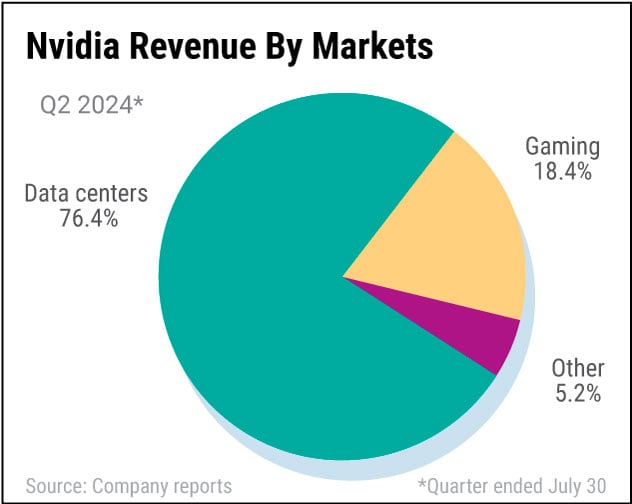

Image source: Voronoi; investors.com