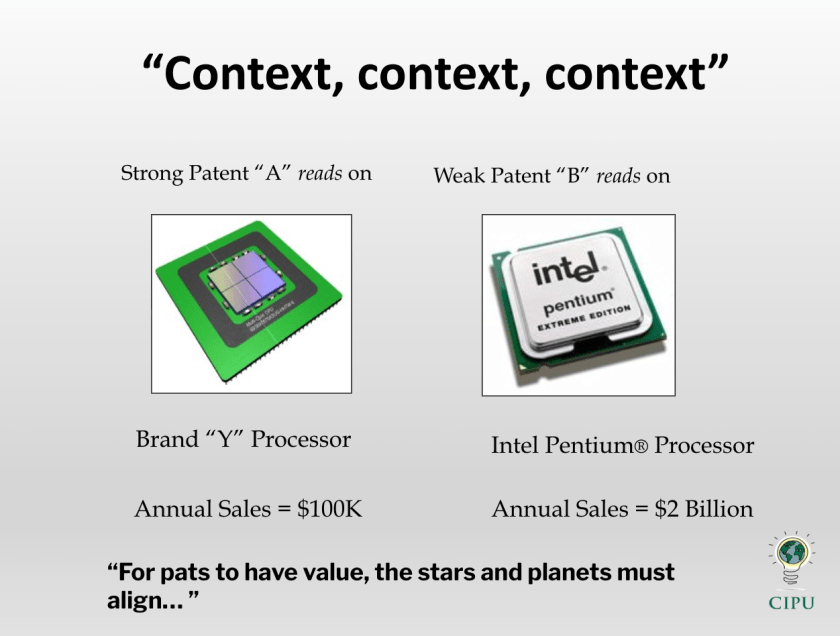

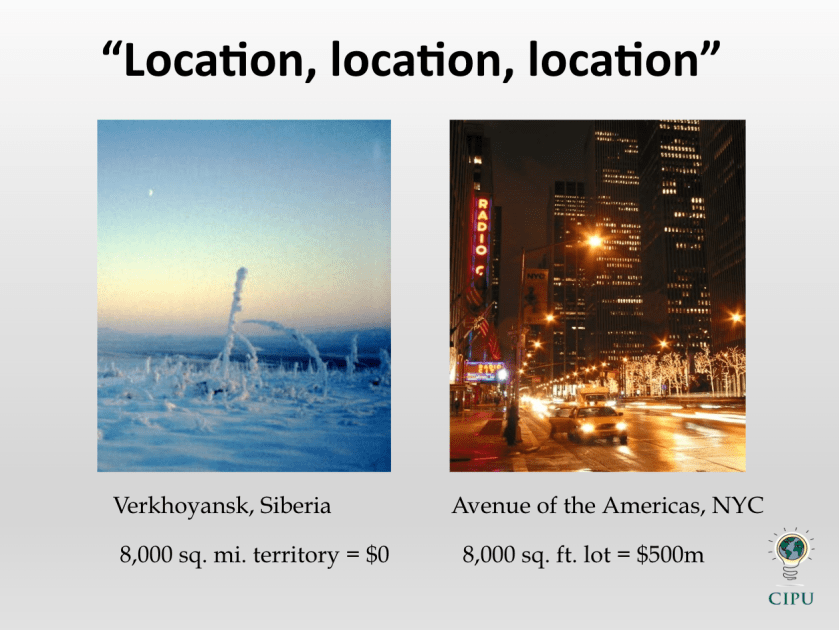

In real estate value is determined by primarily three factors: location, location, location. For intellectual property rights, especially patents, the location is context.

Investors are often blinded by the potential of owning an IP right, or of owning shares in a business that owns them. On first glance it looks like a no-brainer, IP means ownership, which means value and revenue. But intangible assets are not as predictable as hard ones. Best-case scenarios are for the those who don’t know better.

IP valuation is based on a host of market factors and timing. They can be useful in an abstract, theoretical way for securing capital or as a basis of discussion for transactions but those conclusions are different from market value. IP market expert Louis Carbonneau CEO of Tangible IP, former Microsoft patent executive and publisher of the respected IP Market Insights is a patent transaction expert. He is reminded on a daily basis that IP valuation is not IP market value.

What is a willing business, investor or individual willing to pay for a patent or portfolio at given time?

The market determines the real value of everything; and the market can be unforgiving without marketplace, which patents typically lack. There are a host of risk factors for most patents, depending on the USPTO class it falls under and industry, exacerbated by poorly drawn legislation, myopic courts and predatory infringement.

“I want to tackle head-on the persistent confusion between patent valuation and patent value—two concepts that inventors, investors, and even some seasoned IP professionals continue to conflate to their considerable detriment.”

Market value is somewhat easier to assess for trademarks, where, like real estate, there are comparables and revenue streams as context. Copyrights, too, can have a more determinable market value based on the revenue stream associated with a particular work of creative expression, like a song, book or design. Also, royalty rates in some industries (book publishing) are somewhat more standardized.

I have said in the past that an IP right such as a patent, is 100% of something — 98% of the time, in most industries, the something is nothing. Zero value. Exciting on paper, perhaps. Less so in transactions.

Entertainments like “Shark Tank” do little to put finance or IP into perspective, giving patents a distorted status that few small businesses will ever be able to monetize.

Forget Dialing “911”

The way it was taught to me by leading patent attorneys at Kenyon & Kenyon, think of a patent as a mining claim. A government agency issues you a determination, more preliminary than definitive, that a particular claim is yours and yours only. If the land is attractive for development, or if there are valuable minerals beneath it, it could have significant value. But you need to be able to defend your claim against those who want to steal it. You can’t dial 911 and say “Arrest that person, he’s stealing my property!”

If an alleged infringer is unwilling to discuss a financial arrangement or license – and often they are not – YOU will have to fund the dispute. It will take at least three years and several millions of dollars to possibly prevail, and typically for fewer dollars than your you believe you are owed. Many substantial jury awards are never paid, overturned by dubious courts.

Big companies in tech, Alphabet, Meta, Microsoft, Apple, hold tens of thousands of patents each, but use them mostly for defensive purposes. All but a handful will never be put to the test in litigation. They are used as a fence to dissuade large predators, not to generate royalties by using infringed patents against them.

“Consider this your reality check, delivered with the tough love that only someone who lives and breathes this market every day can provide.”

Louis Carbonneau’s “The Inconvenient Truth About Patent Values,” his analysis of IP valuation vs. market value is so well articulated that I would rather provide you access to it than try to capture what he is saying. It is worth reading.

Don’t Trust Best Case Scenarios

Patents can be valuable but what Carbonneau is saying is that they must be regarded in context – several contexts, not only in a best-case scenario, where 100% of something, frequently looks more substantial than it is. Managing IP expectations has become a best industry practice that people, like Louis, on the frontlines of patent transactions, are all too familiar with.

Image source: Brody Berman Associates