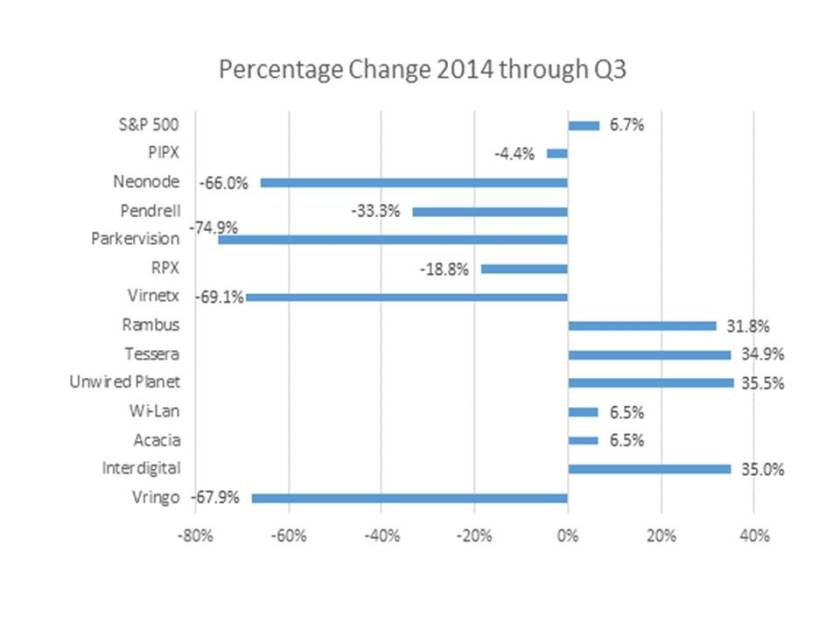

The stock market continues to defy expectations. Even more surprising, a few PIPCOs have dramatically outperformed it. Smaller cap patent stocks have not fared so well.

A handful of patent licensing companies are poised to end 2014 on a resoundingly high note. Early indications are that InterDigital and Tessera Technologies are among those that have likely benefited from the positive momentum generated in the fourth quarter, fueled by a 67-month bull run.

With the S&P 500 up 11.44% at the close of trading on December 9, Tessera (NASDAQ: TSRA) is up 82.39% YTD, and most of that in the fourth quarter. It was up “only” 34.9% through the third quarter. (See TSRA’s performance through the third quarter in the Freescale chart below.)

Unwired Planet (NASDAQ: UPIP) on the other hand is up 8% YTD after having been up 35.5% at the end of the third quarter, dropped dramatically in the fourth quarter. InterDigital (NASDAQ: IDCC), up a respectable 35% at the end of the third quarter, is currently at 81% YTD. Another beneficiary of good tidings and market momentum. IDCC, TSRA and, to a lesser extent, Rambus (NASDAQ: RMBS), have been quietly generating credibility for patent licensing stocks. (In a future IP CloseUp we will be analyzing their largest investors.)

Many Nanocaps Suffer

Many of the nanocaps, PIPCOs whose market capitalization does not exceed 100M, continue to be down for the year and quarter. Some like ParkerVision, Vringo and VirnteX have been dragged down by adverse decisions in court. Others, like DSS and Inventergy have had difficulty showing they can turn patent licensing into a sustainable public business. Notably, IDCC, which ballooned to $75.72 on August 7, 2011, a five-year high, has steadily climbed back up to $53.39 after sinking as low as 25 on July 22, 2012. Some patent licensing stocks appear to be more resilient than others. Often that grit is based on (1) cash flow and (2) cash on the balance sheet. (Cash was king long before Lebron.) Stay tuned to see how the year will end for PIPCOs and which companies have been able to take advantage of the still running bull.

Image source: Freescale Semiconductor; Yahoo! Finance

Notably, IDCC, which ballooned to $75.72 on August 7 What year? Not this year.

LikeLike

2011, following the Rockstar-Nortel and Google-Motorolla deals.

LikeLike

Thanks just wanted to clarify.

LikeLike