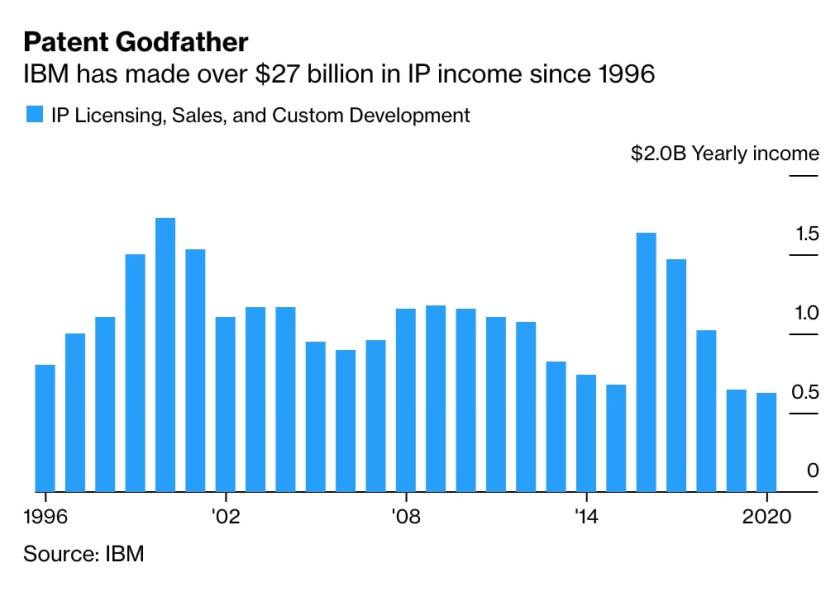

For most years since 1996 IBM, the perennial annual U.S. patent recipient and licensing leader, generated $1 billion or more in intellectual property revenue, $27 billion in total.

Over 2019 and 2020, however, Big Blue generated only about $600 million in direct IP income, $626 million in 2020, to be precise. This comes amidst overall decline in company revenue.

It is unclear if the decline is an aberration due to changing technology or a secular change regarding how IP is valued and monetized, brought on by adverse legislation, unsympathetic courts and emboldened licensees.

As recent at 2016 IBM produced $1.7 billion in IP licensing, much of it from patents, but a significant amount from copyright, brand and know-how related deals with clients and even competitors. Moreover, IP revenue is typically high-margin income, much of which goes to the bottom line and and enhances earnings per share.

Effective Monetization

“The value of patents isn’t calculated just by the revenue they [IBM] generate,” said Chuck Jones in Forbes back in 2016. That is still true today. IBM has learned to use its patents and other IP rights in creative ways to encourage client relationships and, in recent years, to file suit, when necessary. It achieved an $83 million Groupon win in 2018.

But IBM can not live by patent litigation or portfolio sales alone. (It has sold groups of patents to ready-to-go public companies, including AirBnB, Facebook and Twitter.) Last year, IBM’s income from intellectual property was its lowest since 1996. While it continues to secure licensing deals, they are fewer and harder-won, with more costly litigation necessary to achieve them.

“IBM may be recognizing its glory days as the don of patents are waning,” reports Bloomberg News. “The company is exploring alternate ways of capitalizing on its intellectual property,” IBM President Jim Whitehurst said in a recent interview at the Montgomery Summit.

Big Blue’s acquisition of open source software business Red Hat in 2019 for $34 billion may be less a harbinger of things to come than the need to recognize more diverse ways of generating ROI on patents and other IP rights.

“The patent license model isn’t the future of how you monetize innovation,” said Whitehurst.

Image source: IBM via Bloomberg.com

2 comments