Meta has a surprisingly low patent power rating and Snap, the consumer electronics and augmented reality business, has an unexpectedly high one. The reasons for the difference reveal tech company strategies that are not always obvious to executives or investors.

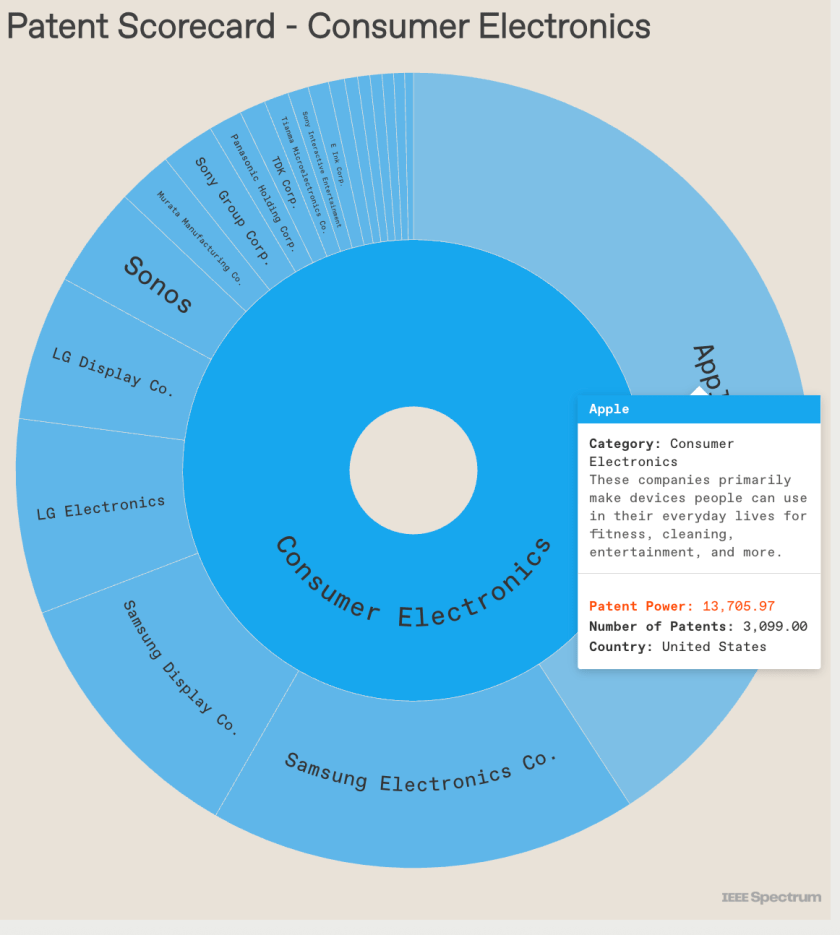

Amazon, Apple, Snap, Samsung, and Qualcomm are 2024’s leaders in patent quality.

According to a recent article in the IEEE Spectrum, a publication of the Institute of Electrical and Electronics, a prestigious professional society that helps to establish standards in the electronics space, some companies may have a lot of patents but they are far from equal

IEEE helps to differentiate patent quality and potential value based the frequency with which new patents recognize existing ones.

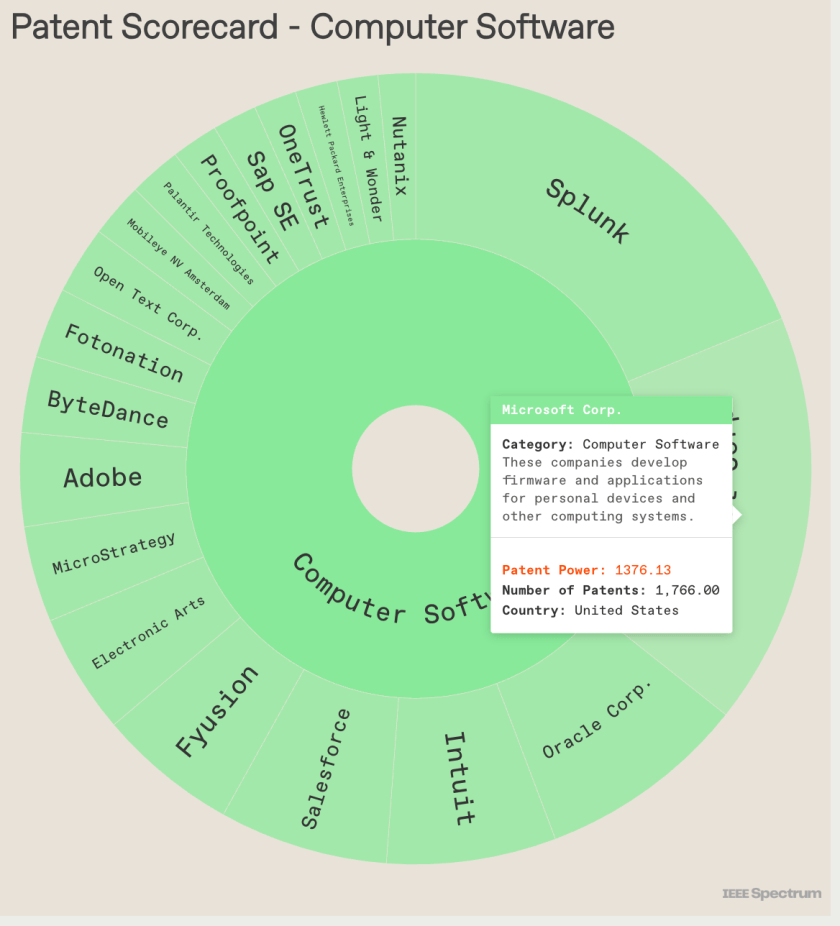

Strength based on citation frequency is not a new approach but one that can still be revealing. The article features interactive data visualizations that help to illustrate company IP strength within specific industries. It gives viewers the option of quickly searching the relative position of individual companies and their industries.

Subsidiaries are important to understanding patent strength, reports IEEE researchers, 1790 Analytics. Where are the patents hiding out? In subsidiaries and businesses with no obvious connection to the business. The patents, arguably, are hiding in plain sight.

R&D, a Dubious Indicator

According to the IEEE-commissioned research, Meta’s patent quality is surprisingly low, especially considering the company’s size and hefty research and development budget. In 2024, the social media giant spent US $43 billion, an amount surpassed only by Alphabet in one survey. (Notably, the survey omitted Amazon because it doesn’t report R&D expenses as a separate line item. (Amazon’s 2023 R&D spend is estimated by R&D World to be $59.8 billion.)

Patent quantity, which surely means something and may have greater relevance in some industries, is a poor indicator of patent quality and value. To measure strength, 1790 analytics used factors, in addition to citation frequency, such as growth, originality and impact.

Even with a more open innovation strategy Meta’s lack of patent strength is notable. Remember, that just before Facebook went public in 2012 it purchased a trove of 750 patents from IBM, presumably because they would help address deficiencies in their portfolio at the time. It is unclear if or how the patents were used.

IEEE has been tracking patent quality with citations since 2006. It points out the the turnover in patent quality leadership from primarily semiconductors and computer systems to Internet services—the category labeled “Telecom and Internet”—and consumer electronics.

Monetization via Risk Mitigation

Many tech patents are only as valuable as their potential for litigation success; others are clear for defensive purposes. It’s difficult to see Amazon or Apple using their patents for licensing or aggressively in litigation. Snap, with a current stock price of $7 from a 2021 high of $77 and market cap of $12 billion, a fraction of the Magnificent Seven companies, may think otherwise.

It remains to be seen how meaningful many of the Apple and Amazon patents are defensively in risk mitigation, their primary intention, and a metric difficult to quantify.

In 2006, semiconductor manufacturer Micron Technology came out on top. IBM, Hewlett-Packard, Intel, and Broadcom were included in the top five.

The rankings are based on Pipeline Power, a scale calculated by 1790 Analytics that combines several elements of an organization’s patent portfolio into one number. In addition to the number of patents granted in a given year, this metric takes into account four variables representing the quality and impact of those patents.

Image source: IEEE Spectrum